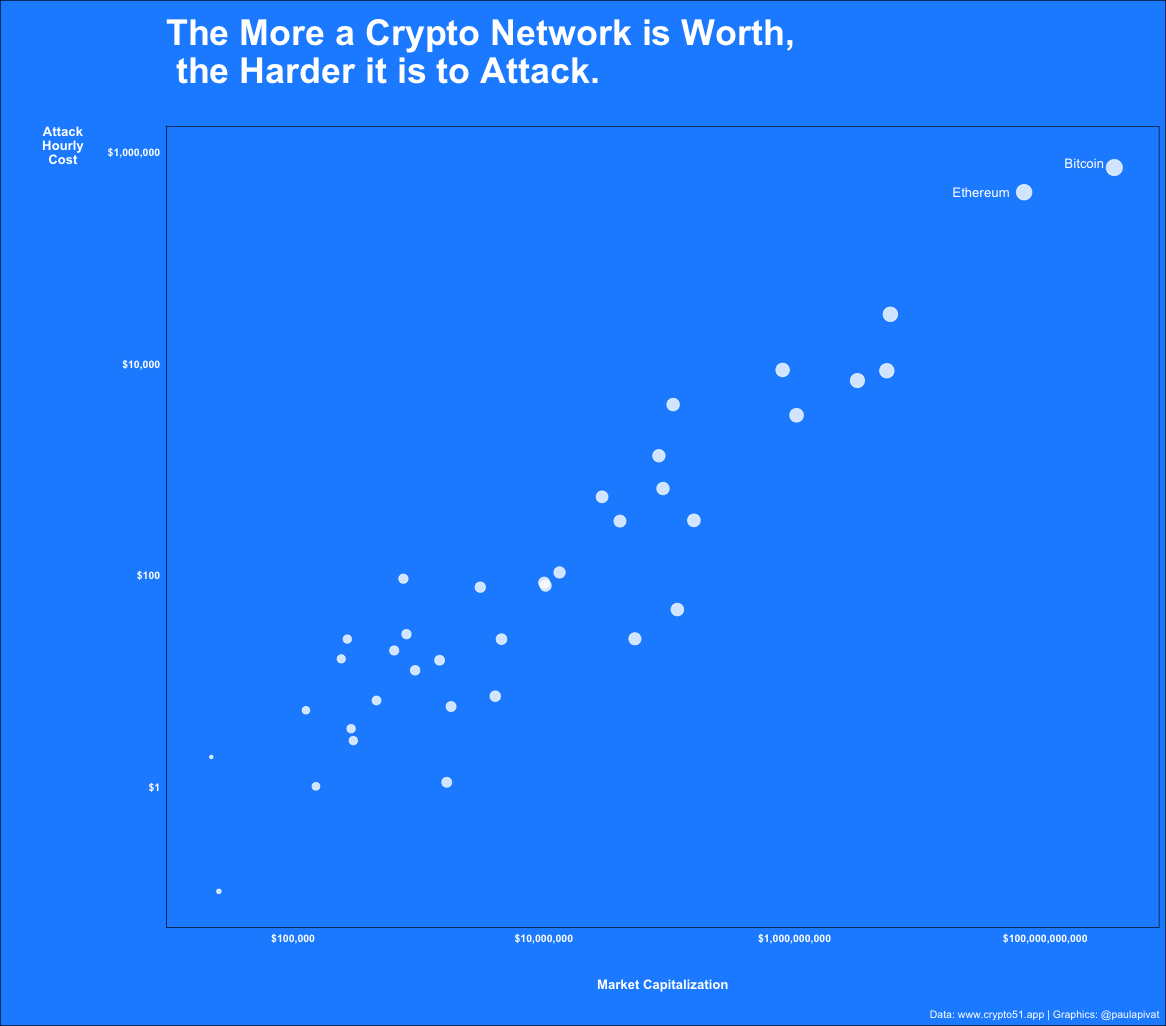

The More a Network is Worth, the Harder it is to Attack

Visualizing the Relationship between Market Cap and Cost to Attack

Table of contents

Overview

In this post, I use Python and R to access, parse, manipulate, then visualize data from Crypto51.app to show the strong relationship between Market Capitalization and Cost to Attack among public crypto networks.

The more a network is thought to be worth, the more expensive it is to attack. An important, but often overlooked reason to celebrate price gains.

Data

In this post, I query an API endpoint setup at

Crypto51.app to get JSON data. Then, I use Python to parse and convert to dataframe. Finally, I use R to wrangle and visualize.

Let’s get it!

Here is the Python code to read in JSON and convert to a dataframe:

import pandas as pd

import json

import requests

r = requests.get('https://api.crypto51.app/coins.json')

dct = dict()

dct = r.json()

# loop through:

# last_updated

# coins

for x, y in dct.items():

print(x)

type(dct['coins']) # list

len(dct['coins']) # 57 dictionaries in side this list

# convert list of 57 dictionaries into a pandas dataframe

df = pd.DataFrame.from_dict(dct['coins'])

df.head()

df.to_csv('crypto51.csv', index=False)

After creating a CSV, I’m transition to R, out of preference for dataframe manipulation and visualization with this tool (you could do the following in pandas and seaborn).

We’ll load the tidyverse and read in the CSV file we created. Then we’ll use a series of magrittr

pipes to sequence our data manipulation in one flow. We’ll remove projects with no market_cap data. We’ll remove the Handshake project because of missing data for attack_hourly_cost.

We’ll change attack_hourly_cost data type into numeric. Then we’ll use ggplot2 to visualize a scatter plot with both X and Y axes transformed with scale_*_log10() to make the scatter plot more interpretable.

Bitcoin and Ethereum are annotated as the two leading projects (see chart below).

library(tidyverse)

df <- read_csv("crypto51.csv")

df %>%

# remove projects with no market_cap

slice(1:38) %>%

filter(attack_hourly_cost != "?") %>%

# change character to numeric

mutate(

attack_hourly_cost = as.numeric(attack_hourly_cost)

) %>%

ggplot(aes(x=market_cap, y=attack_hourly_cost)) +

geom_point(aes(size = log10(market_cap)), color = "white", alpha = 0.8) +

# use log10 transformation to make chart more interpretable

scale_y_log10(label= scales::dollar) +

scale_x_log10(label= scales::dollar) +

theme_minimal() +

theme(

legend.position = 'none',

panel.background = element_rect(fill = "dodger blue"),

panel.grid.major = element_blank(),

panel.grid.minor = element_blank(),

plot.background = element_rect(fill = "dodger blue"),

plot.title = element_text(colour = "white", face = "bold", size = 30,

margin = margin(10,0,30,0)),

plot.caption = element_text(color = "white"),

axis.title = element_text(colour = "white", face = "bold"),

axis.title.x = element_text(margin = margin(30,0,10,0)),

axis.text = element_text(colour = "white", face = "bold"),

axis.title.y = element_text(margin = margin(0,20,0,30), angle = 0)

) +

labs(

x = "Market Capitalization",

y = "Attack\nHourly\nCost",

title = "The More a Crypto Network is Worth,\n the Harder it is to Attack.",

caption = "Data: www.crypto51.app | Graphics: @paulapivat"

) +

# annotate instead of geom_text

annotate("text", x = 205174310335, y = 800000, label = "Bitcoin", color = "white") +

annotate("text", x = 30762751140, y = 418437, label = "Ethereum", color = "white")

Implication

The More a Crypto Network is Worth, the Harder it is to Attack

All time high.

You’d be hard pressed to find three more delicious words than these.

When it comes to crypto, everyone keeps an eye on their portfolio value.

Your bags aside, there is another reason to celebrate price gains.

Bitcoin’s big innovation was making digital transaction difficult to replicate (unlike most digital files that are easily duplicated).

Nodes follow the longest chain as the “correct” chain. However, this opens things up for any node(s) with more than 51% of the network hashing power to pull shenanigans, such as double-spending. Sending funds to one address on the main chain and the same funds to another address on a different chain.

More hardware and hash power allow a node to secretly mine a side chain, which they can later “fool” the rest of the network into accepting.

Since their inception, Bitcoin and Ethereum have gotten more difficult to mine over time. And when price increases, the capital costs of buying new equipment goes up.

This makes it more difficult for any one entity to accumulate too much hash power and pull shenanigans. As a result, the entire network is more secure.

In fact, the data provided by crypto51.app suggests a near perfect correlation between Market Capitalization and Cost to Attack, at r = 0.94.

The more a crypto network is worth, the more expensive it is to attack.

Another reason to celebrate price gains.

References

For more content on data science, machine learning, R, Python, SQL and more, find me on Twitter.